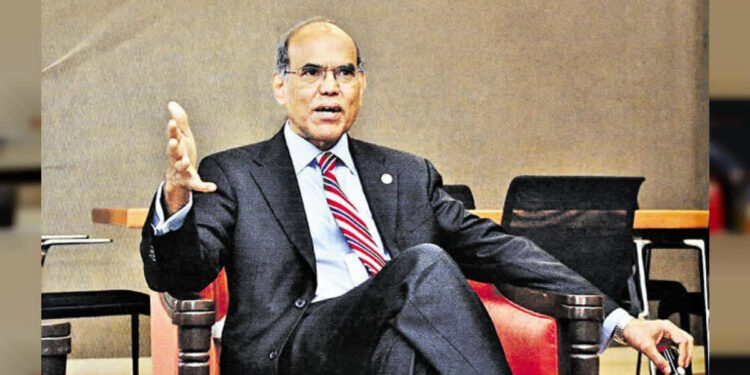

As India gears up for the Union Budget, the economy faces multiple challenges, including slowing GDP growth, inflationary concerns, and geopolitical instability. Former RBI Governor D Subbarao, in a pre-budget discussion, shared his insights on key issues such as taxation, fiscal discipline, investment revival, and monetary policy.

India’s GDP growth has decelerated to 5.4% in the second quarter, raising concerns about economic momentum. While some attribute this to temporary factors like reduced public infrastructure spending due to elections and external shocks, Subbarao sees deeper structural issues. He argues that post-pandemic growth was largely fueled by government expenditure, which is unsustainable. To ensure long-term stability, India must pivot toward private consumption, private investment, and exports. With consumption growing at just 4%, economic benefits remain unevenly distributed, making structural reforms crucial for inclusive growth.

The upcoming budget, Subbarao stresses, must prioritize sustainable and broad-based growth. Strengthening demand, particularly among lower-income groups, can stimulate production and employment. Key structural reforms—especially in labor laws, land acquisition, and taxation—are essential to create a more business-friendly environment. As global firms adopt a ‘China-plus-one’ approach, India has a strategic opportunity to attract investment. Supporting labor-intensive industries and MSMEs will also be critical for job creation and economic resilience.

Despite calls for tax cuts to boost investment and spending, Subbarao believes fiscal constraints make them unrealistic. Instead of temporary tax relief, he advocates for long-term economic restructuring. He acknowledges the government’s fiscal deficit target of 4.9% but warns that India’s high debt-to-GDP ratio of 80% poses significant risks. Excessive debt curtails productive government spending, fuels inflation, and deters private investment. Sustainable fiscal management, with better coordination between central and state governments, is essential for long-term economic health.

India’s Fiscal Responsibility and Budget Management (FRBM) Act has played a role in ensuring financial discipline, but Subbarao suggests it needs reform. Rather than focusing solely on fiscal deficit reduction, he proposes shifting attention to revenue deficit control and debt sustainability. Unlike advanced economies, India’s low revenue-to-GDP ratio makes excessive borrowing risky. Additionally, dependence on foreign capital leaves the economy vulnerable to external shocks. Strengthening fiscal discipline will enhance economic stability and investor confidence.

Another major concern is the rise of populist policies, where states promise unsustainable freebies, burdening public finances. While targeted welfare schemes are necessary, indiscriminate giveaways weaken long-term growth prospects. Instead, investments in skill development and employment generation should be prioritized. A national consensus on fiscal responsibility can prevent reckless spending and promote sustainable progress.

On monetary policy, Subbarao dismisses the argument that high interest rates are holding back private investment. Instead, he points to weak demand as the primary constraint, stressing that monetary easing alone will not revive economic activity. Structural reforms and demand-side measures are more effective in boosting investments. He also opposes excluding food prices from inflation calculations, arguing that food inflation significantly influences consumer sentiment and expectations.

Regarding the rupee’s depreciation, Subbarao advises against excessive RBI intervention, advocating for a market-driven exchange rate. Artificially stabilizing the currency, he warns, could harm exports and long-term competitiveness.

Ultimately, Subbarao emphasizes that economic growth must be inclusive. Policymakers must focus on job creation, skill development, and ensuring that growth benefits all segments of society. The upcoming budget presents a vital opportunity to lay the foundation for both economic expansion and equitable progress.

Full interview is available on: – https://www.youtube.com/watch?v=dLM46_pRurs&t=3s

Discussion about this post