Except for banks/Financial Institutions (FIs) and some corporates, government borrowing per se was not a topic of interest. However, the growth in financial literacy among general public and the frequent media debates have brought government borrowing programs into focus of late. What is government borrowing? Who are the lenders or investors? Why do governments borrow? What type of financial instrument is used for borrowing purpose? Is there any risk associated with government borrowing? Let us try to understand.

Though governments borrow from various sources, government borrowing generally refers to the borrowings by central and state governments to meet the fiscal deficit through issuance of long term bonds (dated securities). Major investors in these securities are banks and financial institutions because these securities have SLR (Statutory Liquidity Ratio) status.

The financial needs of a government is similar to that of a corporate. Therefore, for easy understanding, let us try to understand the need of borrowing from a corporate’s angle.

Why did the Kerala government issue such long dated securities? At the short end of yield curve also, the issue would have got fully subscribed. On the same day, Madhya Pradesh borrowed Rs 500 crore with TTM 1.5 years at 5.73% and Maharashtra borrowed Rs 5,000 crore with TTM 10 years at 7.83%. Prudence dictates that long term borrowings are resorted to when the interest rates are lower because funds would be available at a cheaper rate for a longer period

A corporate, say a manufacturing company, needs to borrow mainly for two purposes: Long-term borrowing for creating long term assets viz. land/building /machinery, etc., and short-term borrowing (working capital) for creating short term assets viz. raw materials/consumables/finished goods/receivables, etc. The long-term assets are created first, to build factory and machinery and there after the production activity starts. The corporate starts making revenue/surplus by selling the finished goods in the market. From this surplus, the long-term finance is slowly liquidated over the tenure and the corporate reaches self-sufficiency over a period. Long-term borrowings are also availed, when there is further addition or replacement of long-terms assets.

Theoretically, a government also works on a similar line. Long-term borrowings are taken to create infrastructure (long-term assets) which in turn facilitates production/growth initiatives. When production grows, income level also grows and government revenue – through direct and indirect taxes – also increases. From the surplus income, the loan can be paid back. This is repeated till the country achieves complete development and borrowing is no longer required. The posterity gets a ‘God’s own country’ without any strings attached.

What is happening in reality? The government continues to borrow more every year but creation of good infrastructure or productive assets hardly matches the borrowings. The borrowed money is often diverted for non-productive purpose and therefore the income level of the country does not increase for the repayment of debt. The result is that we are forced to borrow more to repay the earlier borrowings and the accumulated interest. The repayment obligations snowball and we fall in debt trap. This is what we leave for the posterity.

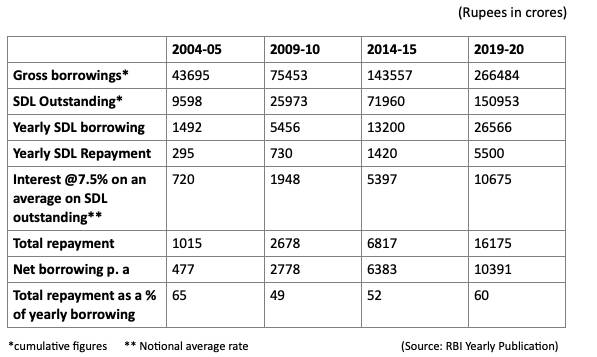

Take the case of Kerala state. In 2005, the accumulated gross borrowing was to the tune of Rs 43,695 crore. In 2019-20, the corresponding figure has leapfrogged to Rs 266,484 crore. Not all borrowings are long-term and used for developmental purpose. The long-term borrowings are referred to as State Developmental Loans (SDLs) and as the name indicates, are for the developmental work of the state. Out of the gross borrowings, the share of SDLs in 2005 was Rs 9,598 crore (22%) and in 2020 the corresponding figure has jumped to Rs 150,953 crore (57%).

The total repayment in 2004-05, which was at Rs 1,015 crore has been moving up progressively and is at Rs 16,175 crore (60%) in 2019 -20. Though our annual SDL borrowings in 2019-20 was at Rs 26,566 crores, the net fund available for development was only at Rs 10,391 crore. Even this amount, probably was not available because a big chunk of this is diverted for consumption and for some populist schemes. As there is no improvement in developmental work, revenue has been in deficit and is at Rs 14,495 crore in 2019-20. The share of salaries and pension alone is at Rs 50,038 crore – almost 50% of the total expenditure of the state! Remember, we have been magnanimous in giving further hike in government salaries this year also. The trend continues and we borrow more year after year to repay earlier obligations – a clear case of debt trap!

As the nomenclature denotes, SDLs are for the development of the state. Unfortunately, these long-term loans are mostly used for consumption purposes; not for development. Earlier, the maximum tenor of SDLs used to be at 10 years. Of recently, states have started borrowing for longer periods viz. 25 years, 30 years, 35 years, etc. Needless to say that the debt trap period gets elongated.

SDLs are fixed income loans and borrowing via SDLs is a different ball game requiring some expertise. The cost of borrowing is reflected in the coupon of the bond. The coupon is dependent on many variables viz. time of raising SDLs, the market perception of the SDL issuing state (borrower), the market liquidity, the size of the SDL issue, etc. A prudent issuer would monitor these variables continuously and would timing the issue in such a way that the cost of borrowing is kept at the lowest possible. However, the finance department of GOK does this borrowing as a matter of routine with the result that we end up paying higher cost for raising SDLs.

For instance, the Kerala government borrowed Rs 5,930 crore on April 8, 2020 in three tranches viz. Rs 2,000 crore with term to maturity (TTM) 10 years, Rs 2,000 crore with TTM 12 years and Rs 1,930 crore with TTM 15 years at 7.91%, 8.10% and 8.96%, respectively. The additional coupon paid on the 2nd and 3rd tranches are 19 basis points (bps) and 105 bps, respectively. In actual terms, for the second tranche for 12 years the additional cost is Rs 45.6 crore and for the third tranche for 15 years, the additional cost is Rs 304 crore. By sheer elongation of the TTM, the additional cost amounts to approximately Rs 350 crore! The coupon on SDLs are paid half yearly. If the half yearly compounding effect also is reckoned, the situation would be worse.

The government could have borrowed the entire Rs 5,950 crore with TTM at 10 years. Why did the government decide to borrow in three tranches? Curiously, one GOK official explained that if the issues are bunched together, at the time of repayment, the government may not have enough resources to repay in one go. The official probably feels that even after 10 years, the government revenue would continue at the same level. He is aware that the borrowings are not for developmental work of the state and therefore the revenue of the state does not improve even after many years.

Secondly, why did the government issue such long dated securities? At the short end of yield curve also, the issue would have got fully subscribed. On the same day, Madhya Pradesh borrowed Rs 500 crore with TTM 1.5 years at 5.73% and Maharashtra borrowed Rs 5,000 crore with TTM 10 years at 7.83%. Prudence dictates that long term borrowings are resorted to when the interest rates are lower because funds would be available at a cheaper rate for a longer period.

Was there any undue haste in conducting such huge borrowings? What were the compelling reasons? If the borrowings were for developmental purpose, there need not have been such urgency. Seeing the high rate at the long end in the auction, the government could have cancelled the issue and tested the market after a little while. Hardly a month later, that is, on May 6, 2020, Kerala government raised two tranches of Rs 500 crore each with TTM of three years and seven years at 5.09% p.a and 6.70% p.a, respectively. One can well imagine how much money we could have saved, had we borrowed the entire amount at 5.09%.

The above is just one example. A detailed audit could reveal the gross nature of the fallacies in conducting the borrowings by the government of Kerala. There appears to be no planning in fund management. Ad hocism seems to be order of the day. There is no accountability.

(The writer is former General Manager, Global Market, State Bank of India)

Discussion about this post